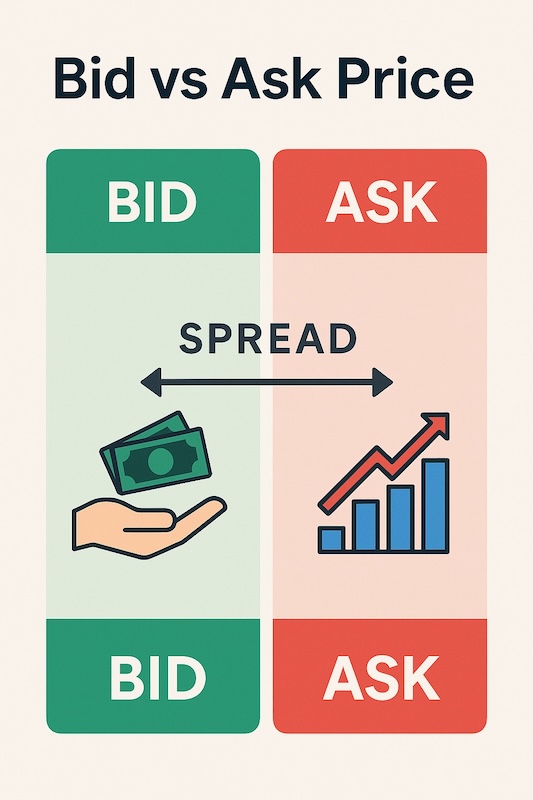

Anyone who has ever looked at a trading screen has noticed two numbers next to every asset: the bid and the ask. At first glance, these may look confusing, but they are the foundation of how markets function. Understanding the bid vs ask price is essential for every trader because it explains not only how prices are set, but also why you pay certain costs when entering and exiting trades.

In this article, we’ll break down bid and ask explained in simple terms, explore the bid-ask spread, and show why this concept matters to everyone from day traders to long-term investors.

What Is the Bid Price?

The bid price is the highest price that a buyer is willing to pay for an asset at a given moment. Think of it as the “demand” side of the market.

- If you want to sell an asset immediately, you’ll sell at the bid price.

- The bid reflects how much traders or investors value the asset on the buy side right now.

Example: Suppose the bid price for Apple stock is $150.25. This means buyers are lined up to purchase shares at that price. If you hit “Sell Market,” you’ll likely sell at $150.25, assuming enough demand exists at that level.

Analogy: Imagine a farmer’s market. A customer walks up and says, “I’ll pay $5 for a basket of apples.” That’s the bid. Sellers can choose to accept it or wait for a higher price.

What Is the Ask Price?

The ask price (sometimes called the offer price) is the lowest price at which a seller is willing to part with an asset. This represents the “supply” side of the market.

- If you want to buy an asset immediately, you’ll buy at the ask price.

- The ask reflects the minimum amount sellers will accept right now.

Example: If the ask price for Apple stock is $150.30, sellers are ready to sell at that price. If you hit “Buy Market,” you’ll likely purchase at $150.30.

Analogy: Back to the farmer’s market. A vendor says, “I’ll sell this basket of apples for $6.” That’s the ask. Buyers can pay it or wait for the seller to lower the price.

The Bid-Ask Spread Explained

The bid-ask spread is the difference between the bid and the ask price. It represents both a cost to traders and a reward to market makers who provide liquidity.

- Formula: Spread = Ask Price – Bid Price.

- Example: If the bid is $150.25 and the ask is $150.30, the spread is $0.05.

Why spreads exist

- Market makers (banks, brokers, specialists) provide liquidity by standing ready to buy (bid) and sell (ask). The spread compensates them for the risk of holding inventory.

- Supply and demand imbalances create spreads. If there are more buyers than sellers, spreads may widen.

- Liquidity levels also matter. Highly traded assets (like EUR/USD or S&P 500 ETFs) usually have tiny spreads. Illiquid assets (like small-cap stocks or exotic cryptocurrencies) can have wide spreads.

Spread and volatility

- In calm, liquid markets, spreads shrink.

- In volatile or uncertain times (earnings announcements, economic data, market crashes), spreads widen as market makers protect themselves from risk.

Why the Spread Matters for Traders

Spreads may seem tiny, but they impact every trader’s performance.

- Transaction cost Every time you cross the spread (buy at the ask or sell at the bid), you pay a hidden fee. For retail traders, this cost is often greater than commissions, especially in “commission-free” accounts where brokers earn revenue through spreads.

- Scalping and day trading For short-term strategies, spreads can make or break profitability. If you aim for small gains (e.g., 0.1% per trade), a wide spread eats up your edge.

- Liquidity signal Narrow spreads usually indicate a liquid, active market. Wide spreads suggest lower liquidity and higher risk. Many traders check spreads before entering a position to gauge market conditions.

- Risk management In fast-moving or illiquid markets, spreads can jump suddenly. This affects stop-loss orders and execution quality. A trader expecting to exit with minimal slippage may be surprised by a wider-than-normal spread during volatile news events.

Example: Forex major pairs like EUR/USD often have spreads as low as 0.5 pips. A micro-cap stock, on the other hand, may have a $0.50 spread on a $5 share — a 10% cost just to get in and out.

Key Takeaways

- The bid price is what buyers are willing to pay.

- The ask price is what sellers are willing to accept.

- The bid-ask spread is the gap between them, representing both trading costs and liquidity.

- Narrow spreads = liquid, efficient markets. Wide spreads = costly, less liquid markets.

- Traders should always pay attention to spreads, as they affect execution quality, profitability, and risk.

FAQ

Why is the ask price higher than the bid?

Because sellers want to receive more than buyers are currently offering. The difference ensures market makers and liquidity providers are compensated for risk.

Who sets bid and ask prices?

They are set by supply and demand in the market. Market participants — both institutional and retail — place buy and sell orders. Market makers often quote both bid and ask to keep trading continuous.

What is spread trading?

In some contexts, spread trading refers to strategies that exploit differences between related assets or contracts. But in everyday trading, “spread” usually just means the cost of crossing the gap between bid and ask.

Are tight spreads always better?

Generally, yes. Tight spreads mean lower costs. However, they may also indicate fierce competition in liquid markets, which can make it harder for traders to find inefficiencies.