When you step into the world of trading and investing, the first question that arises is: what exactly can I trade? Financial markets are full of opportunities, but those opportunities are organized into groups known as asset classes. Each asset class has unique characteristics, risk profiles, and potential returns. Understanding these categories is essential for anyone looking to make informed financial decisions.

This article provides a clear breakdown of the main types of assets available to traders and investors, how they differ, and what role they play in a diversified portfolio.

- What Is an Asset Class?

- Forex (Currencies)

- Stocks (Equities)

- Crypto (Digital Assets)

- Commodities (Gold, Oil, Agriculture)

- Alternative Assets (Real Estate, Bonds, ETFs)

- Key Takeaways

- FAQ

- Which asset class is most profitable?

- What is the safest asset to trade?

- Is Forex better than stocks?

- Should I invest in crypto?

- Why diversify across asset classes?

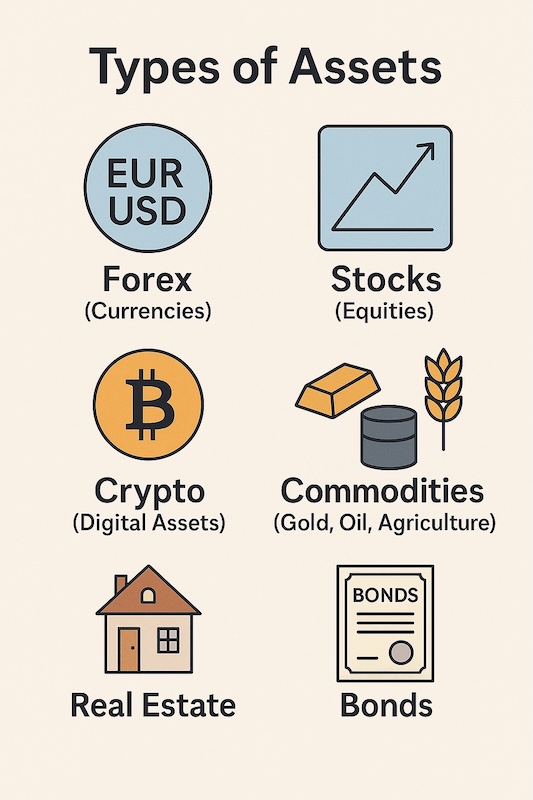

What Is an Asset Class?

An asset class is a group of financial instruments that share similar characteristics, behave in comparable ways in the marketplace, and are governed by the same laws or regulations. By categorizing assets, investors can better understand their risks, expected returns, and role in a portfolio.

The four traditional asset classes are equities (stocks), fixed income (bonds), cash or cash equivalents, and commodities. In recent years, cryptocurrencies and alternative assets have emerged as additional categories.

The main benefit of recognizing asset classes is diversification. Spreading investments across different types of assets can reduce overall risk, since these categories often respond differently to economic conditions.

Forex (Currencies)

The foreign exchange market (Forex) is the world’s largest and most liquid financial market, with over $7 trillion traded daily. It involves the buying and selling of currencies, always quoted in pairs such as EUR/USD or GBP/JPY.

- Nature of the Asset: Currencies represent the relative value of one country’s economy against another.

- Who Trades: Central banks, multinational corporations, hedge funds, and retail traders.

- Pros: High liquidity, operates 24 hours a day, opportunities in both rising and falling markets.

- Cons: High volatility, leverage risk, sensitive to geopolitical and economic news.

Example: A trader might speculate on the EUR/USD exchange rate ahead of a European Central Bank interest rate announcement.

Stocks (Equities)

Stocks, also called equities, represent ownership in a company. When you buy shares of a business like Apple or Amazon, you essentially own a piece of that company.

- Nature of the Asset: Ownership stake, with potential to receive dividends and benefit from company growth.

- Who Trades: Retail investors, institutional investors, pension funds, hedge funds.

- Pros: Historically strong long-term returns; transparent regulation; potential dividend income.

- Cons: Prices can be volatile; company-specific risks (earnings reports, scandals, bankruptcies).

Example: Long-term investors might hold Microsoft stock for decades, while short-term traders buy and sell Tesla shares for quick profits.

Crypto (Digital Assets)

Cryptocurrencies are digital or virtual assets that use cryptography and blockchain technology to secure transactions. They represent one of the fastest-growing but riskiest asset classes.

- Nature of the Asset: Decentralized, digital tokens like Bitcoin, Ethereum, or stablecoins.

- Who Trades: Retail traders, hedge funds, tech-savvy investors.

- Pros: 24/7 market, high volatility (profit potential), innovative technology.

- Cons: Regulatory uncertainty, extreme price swings, security risks (hacks, scams).

Example: A crypto investor might buy Ethereum and stake it to earn passive income, while a short-term trader speculates on Bitcoin’s daily price moves.

Commodities (Gold, Oil, Agriculture)

Commodities are physical goods such as metals, energy resources, and agricultural products. They have been traded for centuries and remain essential to global markets.

- Nature of the Asset: Tangible resources like gold, oil, wheat, or coffee.

- Who Trades: Farmers, producers, manufacturers, institutional traders, and speculators.

- Pros: Good hedge against inflation; diversification benefit; essential for global economy.

- Cons: Prices influenced by unpredictable factors like weather, political instability, and supply disruptions.

Example: Airlines may hedge against rising fuel costs by buying oil futures, while investors buy gold as a safe-haven asset during economic uncertainty.

Alternative Assets (Real Estate, Bonds, ETFs)

Beyond the traditional categories, there are several alternative assets worth noting:

- Real Estate: Provides rental income and capital appreciation. Accessible through direct property ownership or real estate investment trusts (REITs).

- Bonds: Debt instruments issued by governments or corporations. Lower risk than stocks, with fixed interest payments.

- ETFs (Exchange-Traded Funds): Investment funds that track indices or sectors, offering diversification at a low cost.

These alternatives often serve as stabilizers in a portfolio, balancing out the riskier asset classes like stocks or crypto.

Key Takeaways

- Asset classes explained: groups of financial instruments with similar traits and behaviors.

- The main types of assets for traders are Forex, stocks, crypto, and commodities.

- Alternative assets like real estate, bonds, and ETFs add diversification.

- Each class carries unique risk and return potential—no single asset is best for every investor.

- Diversification across asset classes is the cornerstone of risk management.

FAQ

Which asset class is most profitable?

There is no single “most profitable” class—it depends on timing, strategy, and risk tolerance. Historically, stocks have delivered strong long-term returns, while crypto has shown extreme but volatile gains.

What is the safest asset to trade?

Traditionally, government bonds and gold are considered safer assets. However, “safe” does not mean risk-free; every asset carries some level of uncertainty.

Is Forex better than stocks?

Forex offers higher liquidity and operates 24/7, but it can be riskier for beginners. Stocks are generally better for long-term wealth building.

Should I invest in crypto?

Crypto can offer high returns but comes with high risk. It should typically be a small, speculative part of a diversified portfolio.

Why diversify across asset classes?

Because assets often react differently to economic changes, diversification lowers overall portfolio risk.